Tag: Stocks

-

Making changes to my Low Yield Portfolio

While I was in the mood to make changes I took a look at some stocks that profited pretty well in my Low Yield Portfolio and decided to take those profits and put the money into some higher yielding stocks. Here are the stocks where I took profits: Archer-Daniels-Midland (ADM) Albemarle (ALB) Artesian Resources (ARTNA)…

-

Profit taking to take advantage of some losses

Yesterday I wrote how I closed out positions in two PIMCO funds. Specifically I closed out symbols PCKTX and PONPX. The money from those funds went into two closed end funds also from PIMCO. Those symbols are PCN and PFN. You can reference yesterday’s post for more details. The value of those funds declined significantly…

-

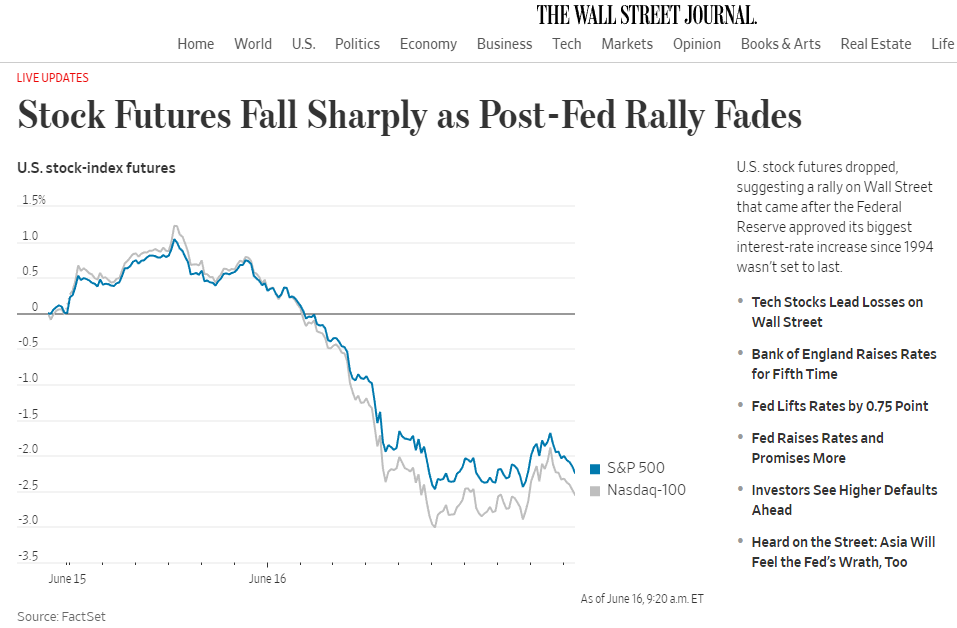

Now is the time to buy not sell

Inflation, record gas prices, record food prices, falling markets, and political turmoil. In the short term this all looks bad. But what is your reason for investing? Are you investing for the quick buck? If so, you’ll be tearing your hair out as you watch thousands, perhaps tens or hundreds of thousands, evaporate from your…

-

I had only one stock in the green today

What stock is that you might ask? It’s Arrow Financial Corporation (AROW). They were up +0.1% letting me know not everything was a loser today. Sheesh! Arrow Financial Corp (AROW) has a current dividend yield of 3.47% and is rated as “Very Safe” by SimplySafeDividends. I hold AROW in my Low and Medium Yield Portfolios.…

-

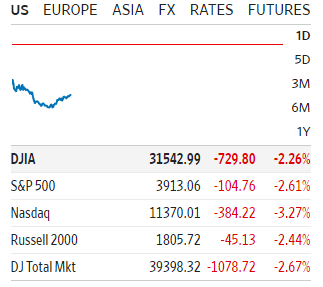

Having another rough day in the markets

I’m not doing better than the Dow today but I am still out performing the S&P and Nasdaq. Here’s to hoping that people start bargain hunting and bring things up a bit towards the end of the day. Personally I’ve felt the Dow in particular is still double where it should be naturally. Something changed…

-

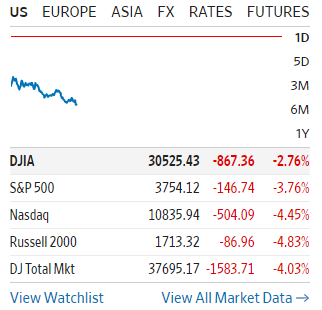

My dividend stocks are out performing the market today

The inflation numbers came out today and the stock market started dropping like a rock. All the indexes are down over 2% with the Nasdaq getting clobbered at 3.27% as of this writing. My three portfolios are down today as well but not nearly to the same extreme as the rest of the stock market.…