Tag: Stocks

-

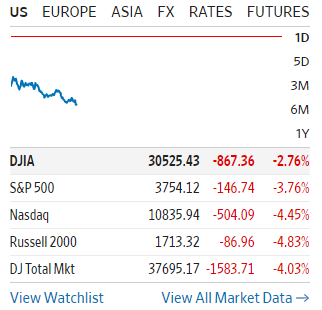

Having another rough day in the markets

I’m not doing better than the Dow today but I am still out performing the S&P and Nasdaq. Here’s to hoping that people start bargain hunting and bring things up a bit towards the end of the day. Personally I’ve felt the Dow in particular is still double where it should be naturally. Something changed…

-

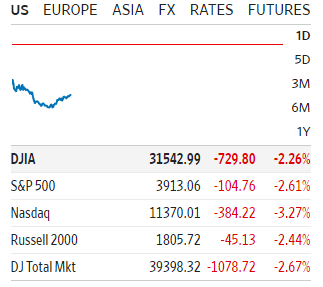

My dividend stocks are out performing the market today

The inflation numbers came out today and the stock market started dropping like a rock. All the indexes are down over 2% with the Nasdaq getting clobbered at 3.27% as of this writing. My three portfolios are down today as well but not nearly to the same extreme as the rest of the stock market.…

-

Investors increasingly look to stocks that produce income

Investors are rushing to companies promising regular payouts to shareholders, a sign of Wall Street’s hunger for cash in hand as the Federal Reserve raises interest rates and major stock indexes struggle. They are turning to companies such as AT&T Inc. and cigarette-maker Altria Group Inc. as the broader market endures one of its most volatile stretches of the past decade. Worries about…

-

Economic uncertainty driving investors to dividend paying stocks

But this time around, a different dynamic is at play. Interest rates have risen swiftly, not because investors are betting on an economic surge, but because accelerating inflation is forcing the Federal Reserve to act quickly to try to rein in price pressures. Some investors worry the Fed’s interest-rate increases may even tip the economy into…

-

Remote recording woes

Trying to record remotely in my car. Portfolio update and more!

-

Public pension funds may be over dependent on stocks

U.S. state and local government pension funds control more than $4 trillion in public-worker retirement savings but will need hundreds of billions of additional dollars to cover promised future benefits. Over the past 12 years, blockbuster stock performance has swelled pension coffers, bringing state and local governments closer to being able to cover those liabilities…