Category: Blog

-

Update: Supreme Court refuses to hear J&J appeal

I’m sure that will cause the stock to decline just a bit. The Supreme Court on Tuesday declined to consider a Johnson & Johnson appeal that sought to challenge a $2.1 billion civil judgment awarded to 20 women who alleged the company’s talcum baby powder caused ovarian cancer. The court rejected the J&J appeal in a…

-

Johnson & Johnson makes an appeal to the U.S. Supreme Court to review baby powder verdict

J&J is asking the court to review the verdict in which a $2 billion verdict was handed down by a jury regarding J&J’s baby powder product. The court could decide as soon as Tuesday if they will hear the case. Johnson & Johnson is asking for a Supreme Court review of a $2 billion verdict…

-

The Yield – Week ending May 28, 2021

Oil companies & renewables, risky bundled loans, Exxon board seats, I-Bonds, and more

-

I Bonds an inflation protected safe investment

Would you consider I bonds? I never did until today. An article in the Wall Street Journal highlighted I bonds as a safe investment that is guaranteed to keep pace with inflation. Introduced in 1998, I bonds were conceived to provide primarily small savers with a positive long-term return after inflation. Their yield consists of…

-

Momentum investing means you’re usually behind the curve

In the short run people might make out. But you’ll never know if you’re getting in when the momentum is subsiding or when it’s just starting to take off. It only works in the long term if the businesses use this opportunity to turn themselves around. If they continue on the same path of being…

-

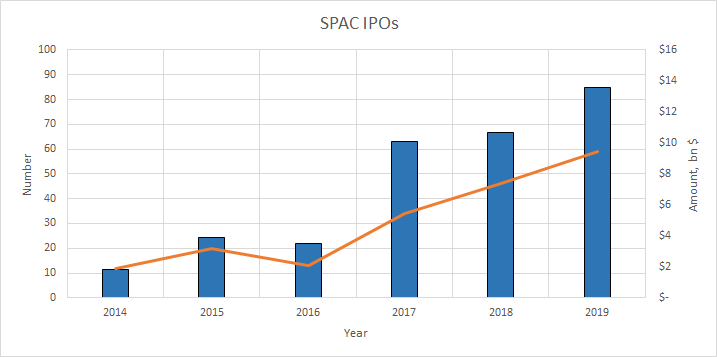

Would you invest in SPACs?

I know investors have made a ton of money doing this lately but it just seems a little scammy to me. It’s like a back door to an IPO without all the scrutiny and regulatory protections. I’m still studying this phenomenon. For private companies, SPACs offer a streamlined alternative to initial public offerings. A SPAC…