Tag: Portfolio

-

Updated all portfolios

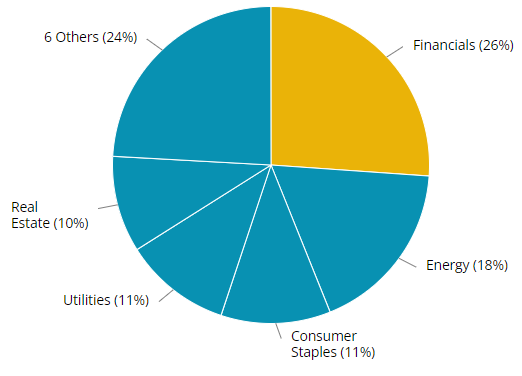

It’s been about a year since I updated the spreadsheets on my portfolios. There have been some changes since May of last year that I never blogged about. You can view the complete portfolio here or you can see each individual portfolio following the links below. Here are some changes to my Low Yield Portfolio…

-

Like a Phoenix Rising

I’m reviving my podcast. This is a short episode just to bring this back to life. Go to podcastindex.org to learn more about Podcasting 2.0. Download a new podcast app where you can stream payments to me or any other podcaster that has Value4Value enabled. Join me next week where I pick this up on…

-

How my income increased $193 by doing nothing

Do you like getting paid for doing nothing? I do! That’s why I love dividend stocks. You buy stock in companies that share profits with their shareholders. Most pay every quarter, some pay monthly, and some of them increase their dividends every year. That means more money for me! In this blog post, I’m going…

-

Mid-year 2023 Portfolio Update

I made changes to my portfolios in 2023 and updated all my portfolio pages. This year has been a stinker if you’re gauging performance by stock price. Dividend income however continues to be steady and rising. Dividend growth across all three of my portfolios is about 3% while total value of my portfolio is down…

-

2021 Yields in Review

2021 comes to an end. Procter & Gamble issues recall, Exxon CFO takes on debt, Self Storage is booming, I review some of my best performers of the year, and much much more!

-

Red Friday not Black Friday

Slow news week, Twitter CEO may step down, Oil rises, Omicron threatens us, Canada releases from its reserves, and much much more!