Category: Blog

-

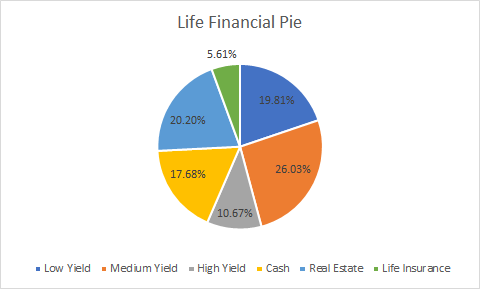

My financial life in pie charts

I thought it might be interesting for people to see my entire asset allocation across stock portfolios, cash, life insurance, and property. Aside from life insurance the assets at highest risk are also the smallest part of the pie. It so happens that the assets at highest risk also provide the highest income. It’s important…

-

Do you rebalance your portfolio?

If you rebalance your portfolio how often do you do it? What are the reasons that you rebalance? I got to thinking more about this after reading an article in the Wall Street Journal this morning. The case for rebalancing is pretty straightforward. Over time, assets whose prices rise account for a growing proportion of…

-

The Yield – Week ending June 4, 2021

J&J, new type of ETF, rising oil prices, and more

-

Biden Administration suspends oil leases in the Arctic

This is why I don’t like Executive Orders. They don’t promote stability. Everyone is subject to the whims of who ever is in office. Allow drilling… don’t allow drilling… and on and on. Just keep the rules consistent so business knows what it can and cannot do. Think of the investments wasted. The Biden administration…

-

Oil prices jump over $70 a barrel today

This explains why my oil stocks jumped today as well. The price of oil was on course Tuesday to close above $70 a barrel for the first time in two years on investors’ optimism that improving oil demand and a dwindling supply glut may mean the market can absorb any additional supply from OPEC and…

-

New ETF bets on interest rate rise

Inflation continues to be on the mind of investors and they’re shifting their strategies to mitigate any drastic change. There is also a looming mistrust of Fed policy with regard to interest rates. Simplify Asset Management recently launched the Interest Rate Hedge ETF, which will seek to take advantage of what its backers see as a…