Retail investors are increasing in number and plowing more money into the markets.

In June, so-called retail investors bought nearly $28 billion of stocks and exchange-traded funds on a net basis, according to data from Vanda Research’s VandaTrack, the highest monthly amount deployed since at least 2014. That even trumped the amount retail traders spent in January during the first meme-stock frenzy.

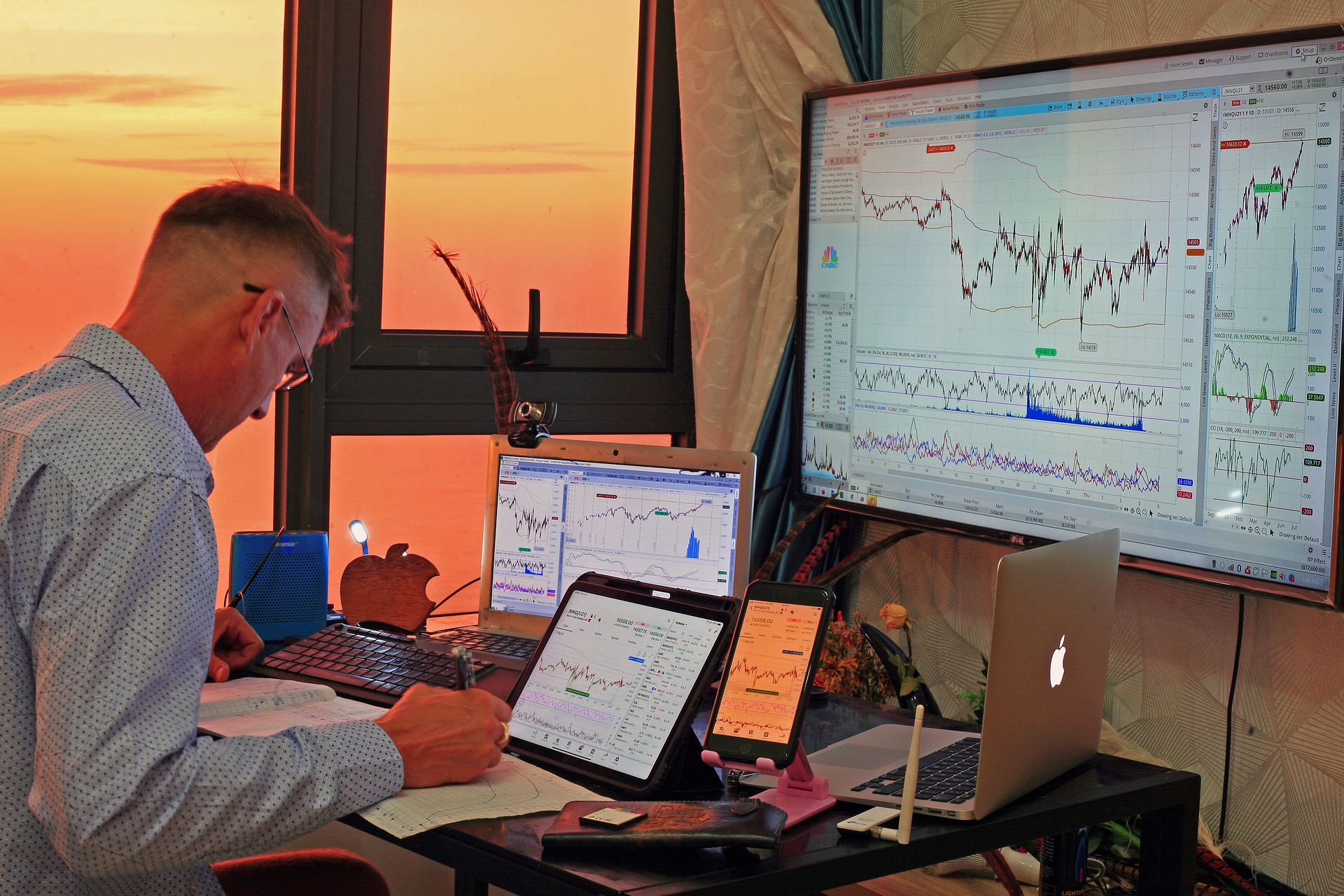

The activity underscores the enduring influence of ordinary investors in markets. When the Covid-19 pandemic ushered in a wave of first-time traders, many market observers suspected these investors would retreat when the economy reopened.

Instead, individual investors have grown in number: More than 10 million new brokerage accounts are estimated to have been opened in the first half of this year, according to JMP Securities. That is around the total for all of 2020.

Wall Street Journal

The problem is they are also increasingly betting on volatile stocks. This is pure gambling. There is no doubt there will be winners but past experience shows that most will be losers. When the market faces a deep correction, which will happen sooner or later, a lot of these new investors are going to lose a ton while the professionals will win big.

Individual investors helped send China-based Pop Culture Group Co. Ltd., a company that develops and hosts hip-hop events, soaring to finish last week at $53.40, days after shares were priced at $6 apiece for its initial public offering. That marks a 790% jump from the company’s IPO price.

Alex Salfetnikov, a 24-year-old Florida resident and full-time trader, has focused of late on volatility among individual stocks. He considers himself a bearish investor—spending most of his mornings betting against biotech stocks on the TradeZero America platform. He also recently turned a quick profit shorting, and then later buying, Marin Software Inc., as it got choppy in late June.

“Volatility is kind of key for a retail trader,” said Mr. Salfetnikov, who leads a small group of traders who pay to access his digital trading room.

Wall Street Journal

I look to invest in good companies that pay dividends. I care about what they will pay me to hold their stock versus what the price of their stock will do. If it goes up great but I will be happy if the stock price doesn’t move much at all.

Image by Sergei Tokmakov www.thecorporateattorneys.com from Pixabay