Chasing the Yield

Investing for income through dividends and distributions

-

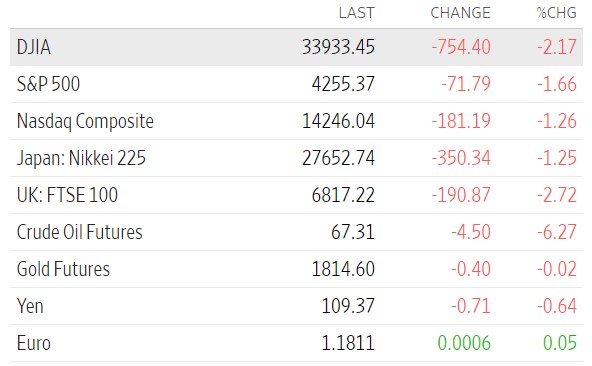

Today’s market dip was not a correction

The drop in the markets today was but a small blip. A correction would have looked more like a 10% drop. Keep your cool. Don’t panic. Your investment goal should encompass more than a single day move in the markets. If you look to the long term you can weather the storms.

-

Exxon names new CFO

Exxon Mobil Corp. has hired Kathryn Mikells as its next chief financial officer, succeeding 43-year company veteran Andrew Swiger as the company’s top financial executive. Ms. Mikells will take over as the energy giant’s CFO Aug. 9, the company said. She previously served as CFO of Diageo PLC, a British beverage company, since 2015. Before…

-

Chasing The Yield Podcast – July 19, 2021

Markets are taking a dive, J&J has more problems, Microsoft blames Israeli group, OPEC reaches compromise, hotels eliminating housekeeping, and much more!

-

Do market days like today make you jittery?

I’m no longer investing for growth. I’m purely investing for income. Portfolio growth is a good side-effect if I can have it but I’m mainly looking for principal preservation. So, let me ask you, if you’re retired now like me & living off your dividends do days like today give you a scare? They shouldn’t.…

-

Hotels may adopt permanent elimination of daily housekeeping service

I used to travel four or five times a year where I stayed in hotels. I continued that a bit during the pandemic. Hotels suspended daily housekeeping services unless you request them. Now that things are loosening up the policy hasn’t changed. It seems the companies operating hotels came to the conclusion people don’t mind…

-

OPEC reaches compromise with UAE

If the compromise takes hold that could lead to a drop in the price of oil. In this post pandemic economy who knows what effect this will have. I expect we won’t notice much of a change in the short term. It’s more important to keep an eye out for the long term trend. Right…