Chasing the Yield

Investing for income through dividends and distributions

-

Consumer staples segment taking a beating today

This is going to be one of those days. Let’s hope it doesn’t turn into something even bigger. The consumer staples segment is 11% of the total of all three of my portfolios. Shares of Philip Morris International, Kimberly-Clark and Mondelez International were all down more than 3%, sliding along with all of the other…

-

South Jersey Industries (SJI) to be acquired

South Jersey Industries (SJI) has a current dividend yield of 3.78% and is rated as “SAFE” by SimplySafeDividends. I hold SJI in my Low Yield Portfolio. In total SJI is 0.7% of my portfolio. According to an analysis of the announcement by SimplySafeDividends South Jersey Industries (SJI) will continue to pay out its dividend through…

-

Bank stocks are getting clobbered

Shares of financial firms in the S&P 500 were down 3% in recent trading, worse than any other sector of the broad benchmark. Morgan Stanley, State Street and Fifth Third Bancorp were among the biggest losers, all shedding more than 4%. The same played out in Europe, with banking stocks in the Stoxx Europe 600…

-

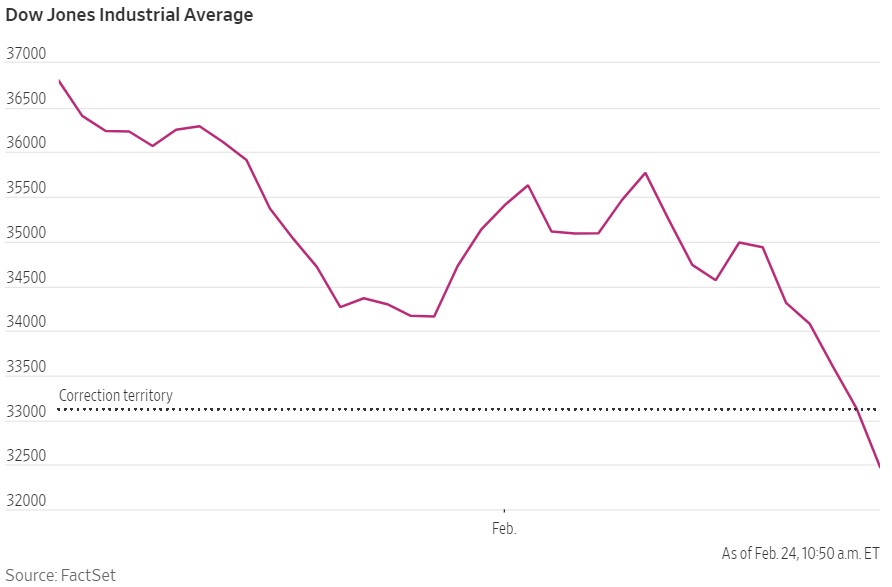

Dow is in corrections territory

Ahhh to live in interesting times. Who wants to be bored again? Count me in. The Dow Jones Industrial Average fell about 630 points, or 1.9%, on course to close in correction territory. The S&P 500 dropped 1.3%; it reached correction territory earlier in the week. The Nasdaq Composite, which was recently off 0.8%, was earlier on…

-

Happy President’s Day

Chasing the Yield – February 21, 2022 Episode 41 Value 4 Value podcastingListen to this podcast on PodFriend News Frackers are fracking again – Chasing the Yield Portfolio Update LowYield MediumYield HighYield Week -0.61% -0.37% -0.84% Month -1.98% +0.25% +1.25% 2021 -4.97% -2.07% +5.31% Dividends Received this Week Amount BP Midstream Partners (BPMP) $501.10 Kinder…

-

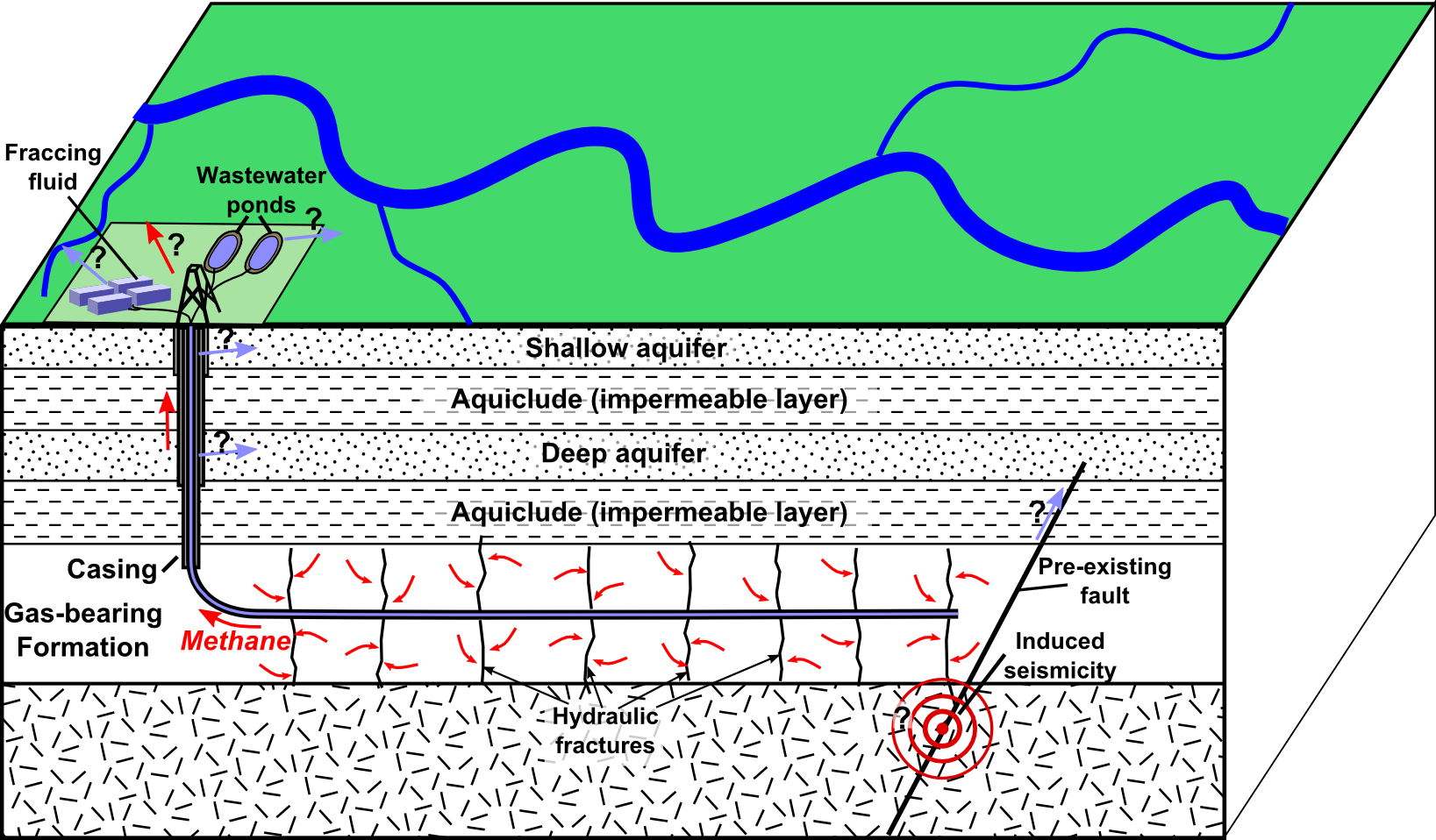

Frackers are fracking again

Private oil producers are leading an industry return to places like the Anadarko Basin of Oklahoma and the DJ Basin in Colorado, where drilling had almost completely stopped in mid-2020 when those areas became unprofitable because of lower oil prices. Oil production in these marginal regions isn’t expected to move the needle in the global…