Chasing the Yield – May 16, 2022

Episode 53

Value 4 Value podcasting

Listen to this podcast on PodFriend

[powerpress]

News

J&J names executives to new consumer healthcare spin-off company

Pension funds suffer in current market conditions

Albemarle (ALB) has a current dividend yield of 0.67% and is rated as “Very Safe” by SimplySafeDividends. I hold ALB in my Low Yield Portfolio. In total ALB is 0.5% of my portfolio.

| Dividend Yield | Dividend Streak | Market Cap | Share Price | Forward P/E | Sector |

| 0.67% | 27 yrs | $28 billion | $237.33 | 23.86 | Materials |

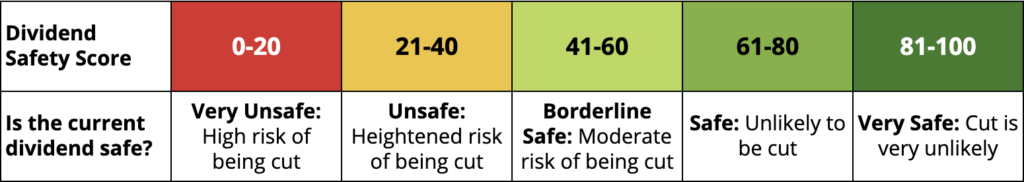

Simply Safe Dividend Rating

Company Profile

Incorporated in 1993 and headquartered in Charlotte, North Carolina, Albemarle is a leading global developer, manufacturer, and marketer of highly engineered specialty chemicals, such as Lithium, Bromine, and Catalysts.

Their Lithium segment develops lithium-based materials including lithium carbonate, lithium hydroxide, lithium chloride, butyllithium, and lithium aluminum hydride. Lithium is an essential component in consumer electronics, electric vehicles, high performance greases, car tires, rubber soles, and plastic bottles. They provide technical services, including the handling and use of reactive lithium products, recycling services for lithium containing by products and lithium metal and other reagents.

Their Bromine segment includes products used in fire safety and other specialty chemical applications. Their fire safety technology enables the use of plastics in high heat applications by enhancing the flame resistant properties. The products that benefit from this technology include plastic enclosures for consumer electronics, printed circuit boards, wire and cable products, electrical connectors, textiles, and foam insulation. This segment includes specialty chemicals such as elemental bromine, alkyl bromides, inorganic bromides, brominated powdered activated carbon, and other bromine chemicals. These specialty bromine chemicals are used in chemical synthesis, oil and gas well drilling, mercury control, water purification, beef and poultry processing and other applications.

Their Catalysts segment is comprised of three main product lines. Clean fuel technologies, fluidized catalytic cracking, and performance catalyst solutions. Clean fuels technology is primarily composed of hydroprocessing catalysts and isomerization and akylation catalysts. Fluidized catalyst systems assist in high yield cracking of refinery petroleum streams into derivative higher-value products like transportation fuels and propylene. Performance catalyst solutions are used in the manufacture of alpha-olefins, polyolefins, and electronics.

Albemarle Investor Information

Sources: Walls Street Journal, CNBC, TD Ameritrade, Simply Safe Dividends

Portfolio Update

| Low Yield | Medium Yield | High Yield | Total Portfolio | |

| Week | -1.17% | 1.55% | -1.78% | -1.45% |

| Month | +0.19% | -1.93% | -1.68% | -1.10% |

| 2022 | -4.14% | -5.80% | +1.85% | -3.80% |

| Inception | +37.82% | +4.00% | -5.20% | +14.85% |

| Dividends Received this Week | Amount |

| Plains GP Holdings (PAGP) | $113.32 |

| Owl Rock Capital (ORCC) | $199.33 |

| Main Street Capital (MAIN) | $47.73 |

| MPLX (MPLX) | $263.67 |

| Omega Healthcare (OHI) | $81.74 |

| Magellan Midstream Partners (MMP) | $283.24 |

| Crestwood Equity Partners (CEQP) | $325.54 |

| Enterprise Products Partners (EPD) | $82.16 |

| NewMarket Corporation (NUE) | $69.50 |

| British American Tabacco (BTI) | $84.37 |

| Pembina Pipeline (PBA) | $99.81 |

| Shell Midstream Partners (SHLX) | $389.40 |

| CrossAmerica Partners (CAPL) | $581.70 |

| Antero Midstream (AM) | $238.05 |

Dividend Events

- MDU Resources (MDU) announced its next dividend of $0.2175 per share, in line with the company’s previous payout.

- 3M (MMM) announced its next dividend of $1.49 per share, in line with the company’s previous payout.

- Prudential (PRU) announced its next dividend of $1.20 per share, in line with the company’s previous payout.

- T. Rowe (TROW) announced its next dividend of $1.20 per share, in line with the company’s previous payout.

- Freedom Fidelity Fund (FFTWX) announced its next dividend of $0.003 per share, bringing the fund’s total payout over the last twelve months up 0.27%.

- Illinois Tool Works (ITW) announced its next dividend of $1.22 per share, in line with the company’s previous payout.

- Pembina (PBA) announced its next dividend of $0.21 CAD per share, in line with the company’s previous payout.

- C.H. Robinson (CHRW) announced its next dividend of $0.55 per share, in line with the company’s previous payout.

- Eastman (EMN) announced its next dividend of $0.76 per share, in line with the company’s previous payout.

Podcasting 2.0

This is a Podcasting 2.0 compatible podcast. This means if you’re listening to this podcast on a Podcasting 2.0 compatible app you’ll have access to transcripts, chapters, and chapter images that accompany each episode. Please go to newpodcastapps.com to download and support these independent apps and go to podcastindex.org to support Podcasting 2.0.

Value 4 Value Podcast Apps

Use the apps below to directly support independent podcasters. It’s easier than you might think to stream fractions of bitcoins to this podcast or any other podcast that is compatible with the Value 4 Value model. This cuts out the need for advertising.

What is Value 4 Value?

The Value 4 Value streaming payments system enables listeners to send Bitcoin micropayments to podcasters as they listen, in real-time. Go to valu4value.io for everything you need to know to begin directly supporting your favorite podcaster.

Disclaimer

Kevin Bae is not a registered investment advisor, broker or dealer. Kevin Bae may have positions in any financial instrument, product, or company mentioned on chasingtheyield.com or on the Chasing the Yield podcast. Information provided by chasingtheyield.com and the Chasing the Yield Podcast is provided for information and entertainment purposes only and are not intended as advice or a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. All opinions are based upon sources believed to be accurate and are provided in good faith. No warranty, representation, or guarantee, expressed or implied, is made as to the accuracy of the information contained herein.

Please contact an investment professional if you have any questions regarding an investment.

Contact

For questions or comments contact me at mail@chasingtheyield.com