Chasing the Yield – April 11, 2022

Episode 48

Value 4 Value podcasting

Listen to this podcast on PodFriend

[powerpress]

News

BP completed their acquisition of BP Midstream Partners and as such I sold my position in BP. I took the proceeds of that sale and distributed it among 4 of my existing holdings. I purchased additional shares in Necessity Retail REIT (RTL), SLR Investment Corp (SLRC), Office Properties Income Trust (OPI), and Arbor Realty Trust (ABR). I did this in order to maintain the level of dividends and distributions I receive in my High Yield Portfolio.

Oil executives reject profiteering claims by Congress – Chasing the Yield

Consumer staples getting squeezed by inflation – Chasing the Yield

Shell expects to take $5 billion hit pulling out of Russia – Chasing the Yield

| Share Price | Sector/Type |

| $22.86 | Oil & Gas Transportation & Storage |

| Market Cap | P/E Ratio | Dividend Yield | Dividend Streak |

| $848 million | 39.18 | 9.19% | 3 years |

3yr Chart

My Shares

| Shares purchased | Avg. Cost per share | Estimated Annual Income |

| 1,108 | 19.34 | $2,326.00 |

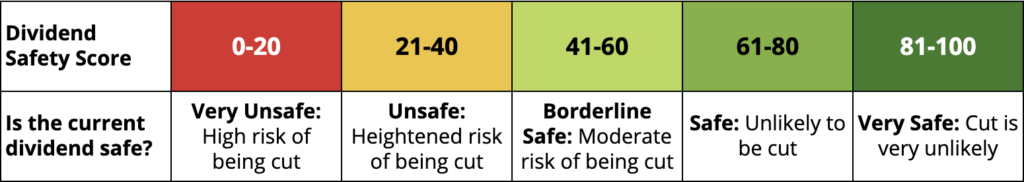

Simply Safe Dividend Rating of 50 – Borderline Safe

Sources: Walls Street Journal, TD Ameritrade, Simply Safe Dividends

Portfolio Update

| Low Yield (2015) | Medium Yield (2019) | High Yield (2021) | Total Portfolio Average | |

| Week | +2.92% | -0.81% | -1.07% | +0.50% |

| Month | +2.92% | -0.81% | -1.07% | +0.50% |

| 2022 | -0.73% | +0.28% | +7.39% | +1.21% |

| Inception | +39.86% | +9.51% | +0.73% | +19% |

| Dividends Received this Week | Amount |

| Kimberly-Clarke (KMB) | *$43.61 |

| Main Street Capital (MAIN) | *$23.34 |

| South Jersey Industries (SJI) | *$70.11 |

| Kimberly-Clarke (KMB) | $76.56 |

Dividend Events

- Plains GP Holdings (PAGP) announced its next dividend of $0.2175 per share, a 21% increase over the company’s previous payout of $0.18.

- Pembina Pipeline (PBA) announced its next dividend of $0.21 CAD per share, in line with the company’s previous payout.

- PIMCO Income Fund (PONPX) announced its next dividend of $0.03903 per share, in line with the fund’s previous payout.

- Necessity Retail REIT (RTL) announced its next dividend of $0.2125 per share, in line with the company’s previous payout.

Podcasting 2.0

This is a Podcasting 2.0 compatible podcast. This means if you’re listening to this podcast on a Podcasting 2.0 compatible app you’ll have access to transcripts, chapters, and chapter images that accompany each episode. Please go to newpodcastapps.com to download and support these independent apps and go to podcastindex.org to support Podcasting 2.0.

Value 4 Value Podcast Apps

Use the apps below to directly support independent podcasters. It’s easier than you might think to stream fractions of bitcoins to this podcast or any other podcast that is compatible with the Value 4 Value model. This cuts out the need for advertising.

What is Value 4 Value?

The Value 4 Value streaming payments system enables listeners to send Bitcoin micropayments to podcasters as they listen, in real-time. Go to valu4value.io for everything you need to know to begin directly supporting your favorite podcaster.

Disclaimer

Kevin Bae is not a registered investment advisor, broker or dealer. Kevin Bae may have positions in any financial instrument, product, or company mentioned on chasingtheyield.com or on the Chasing the Yield podcast. Information provided by chasingtheyield.com and the Chasing the Yield Podcast is provided for information and entertainment purposes only and are not intended as advice or a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. All opinions are based upon sources believed to be accurate and are provided in good faith. No warranty, representation, or guarantee, expressed or implied, is made as to the accuracy of the information contained herein.

Please contact an investment professional if you have any questions regarding an investment.

Contact

For questions or comments contact me at mail@chasingtheyield.com