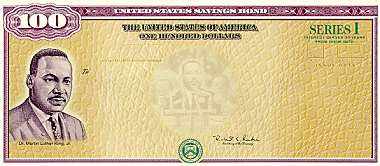

Would you consider I bonds? I never did until today. An article in the Wall Street Journal highlighted I bonds as a safe investment that is guaranteed to keep pace with inflation.

Introduced in 1998, I bonds were conceived to provide primarily small savers with a positive long-term return after inflation. Their yield consists of a fixed rate for the 30-year life of the bond and an inflation rate, which adjusts semiannually. The current 3.54% applies to I bonds issued until Nov. 1, 2021 and will reset every six months unless the official government rate of inflation stays constant.

Wall Street Journal

What if we go into a deflationary period? I bonds are protected against that too. It’s a no lose situation for the investor with the only limits being a maximum of $10,000 per investor and you have to hold it for at least a year.

What if interest rates or inflation head lower? Yes, the yield can decline. But, unlike with Treasury inflation-protected securities, or TIPS, the yield on I bonds can never go below zero. So they protect against both inflation and deflation, which is pretty amazing.

Wall Street Journal

If you are holding $10k in a CD, money market fund, or savings account you might want to consider this option.